Choose a Headline: 1) The arsonists consider plan to put out fire; or 2) Congress set to discuss options to address the student loan debt crisis. Two different headlines, same story. Our elected officials are pondering solutions to one of the many crises they created – out of control student loan debt.

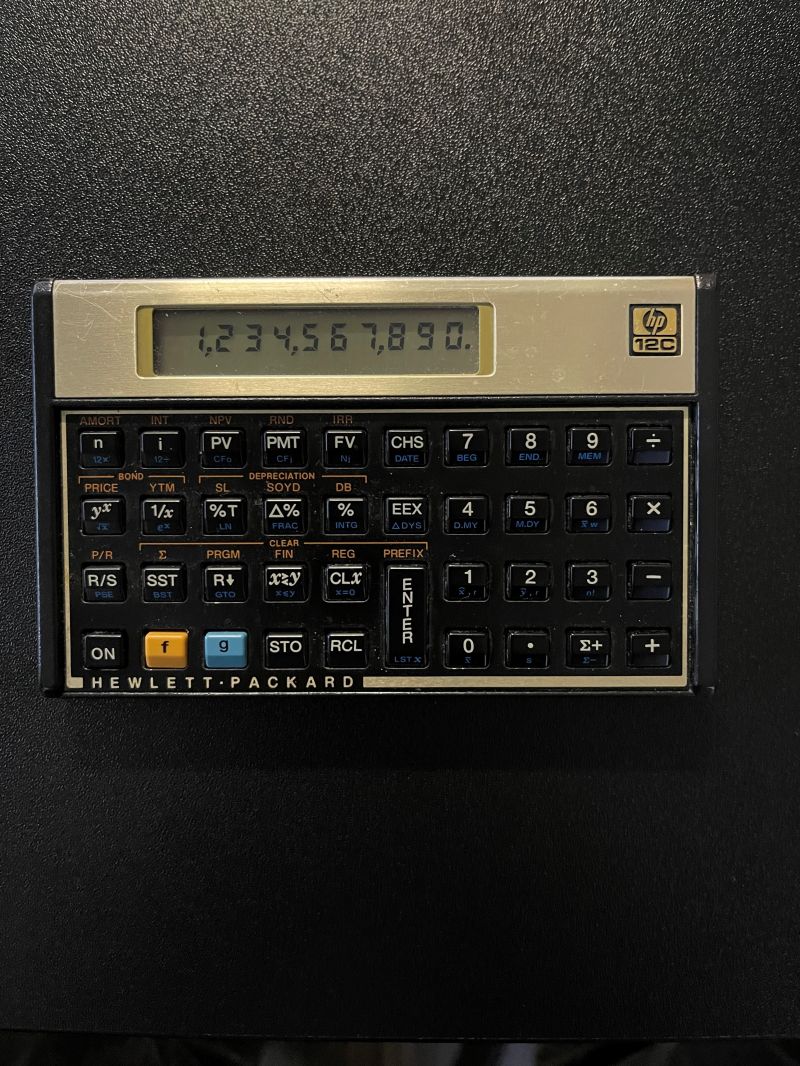

According to various sources, there may be upwards of 43 million borrowers who owe over $1.5 trillion in student loans. It’s difficult to comprehend a number that exceeds the screen capacity of my HP12C calculator (without having to refer to the owner’s manual.) So, let’s put this into perspective. Student loan debt is second only to mortgage debt for U.S. consumers. The difference is mortgage debt is generally dischargeable in bankruptcy, whereas government guaranteed student loans are not.

Bill Rochelle recently covered a case where a debtor incurred $500,000.00 in student loans and held a master’s degree in human services. The debtor was 68 years old at the time of filing Chapter 7 and earned her master’s degree at 55. The debtor was able to earn $43,000 a year working substantial overtime. Unusual circumstance? Hell no. And, unless you have a contingency plan to “break contact,” DO NOT ask a consumer bankruptcy attorney if they have similar war stories.

According to the PEW Research Center, up to 20% of federal student loans are in default. Time will tell if Congress is able to avert a far-reaching financial disaster like the mortgage crisis in 2008. (Another crisis spawned by Congress via lax lending requirements.) Will Congress go back to a reasonable standard for discharge of student loans after a good faith attempt to repay and means testing? Will President Biden’s “forgive a minimum of $10,000 per person of federal student loans” idea be the legislative answer? Although many agree a reasoned solution to soul crushing student loan debt is warranted, the issue is the cost and who will bear the burden?

Will Congress only address the problem at the expense of the borrowers and, alas, the taxpayers? Or will it hold the colleges and universities that facilitated and profited from this disaster accountable (via outrageous tuition increases and bloated budgets)? In my humble opinion, the latter constituency should bear part of the financial pain. These profiteers induced students to pay hundreds of thousands of dollars for a degree they knew would not result in compensation at a level necessary to pay back the debt.

Regardless of your position, stand by. Congress may act before the end of this year. And we are going to have to deal with the fallout.